Beyond Build vs. Buy: Start with Your Resilience Goals

Part I of the "Resilient Supply Chain AI Playbook" series

The AI for supply chain market is projected to reach $60+ billion by 2031, at a CAGR of over 40% from 2024 to 2031. Every week, another vendor promises to revolutionize your operations with AI. Every conference features another build-your-own success story.

And every day, mid-market supply chain leaders are asking the wrong first question: "Should we build or buy?"

Here's the truth: Organizations with higher AI investment in supply chain operations report revenue growth 61% greater than their peers. But they're not winning because they chose the "right" approach. They're winning because they started with a different question entirely: "What does resilience mean for our specific business?"

The past five years have brutally demonstrated that efficiency without resilience is a house of cards. The winners in the next five years won't be those who build the best AI or buy the best AI—they'll be those who design the right AI architecture for their unique resilience needs.

Let's flip the conversation.

The Resilience Revolution

Once upon a time, supply chain excellence meant lowest cost and highest efficiency. That paradigm and it’s ‘happily ever after’ died somewhere between the Ever Given blocking the Suez Canal and the fifth ‘once-in-a-century’ disruption in three years.

Today's supply chain leaders face a new reality:

Demand patterns that would make a seismograph dizzy

Suppliers struggling with their own disruptions

Customers expecting Amazon-level service regardless of global chaos

Boards demanding both growth and stability

"Resilience doesn't come for free," says Sanjeev Maddila, worldwide head of supply chain solutions at Amazon Web Services (AWS). "You have to preplan and deploy resources to ensure resilience, by building flexibility in your supply chain which can both insure against the downside risk of disruptions and prepare your organization for new upside opportunities."

But here's where mid-market companies (~$50-500M revenue) can get stuck. They may find themselves too small to throw Fortune 500 money at the problem, yet too complex for simple solutions (adding spreadsheets is not a recipe for resilience here!) They need resilience, but they need it at a price and pace that makes sense for their scale.

The answer isn't choosing between building or buying AI capabilities. It's understanding that resilience requires a portfolio approach; one that matches solutions and approaches to specific vulnerabilities.

Consider two illustrative examples:

Company A built a proprietary demand sensing algorithm because their customer behavior patterns were unique to their market niche, giving them a powerful edge against their competition

Company B bought best-in-class forecasting because their challenge was implementation speed, more than prediction accuracy

Both improved resilience. Both made the right choice. Because both started with clarity about what resilience meant for their specific situation.

The Four Faces of Supply Chain Resilience

Not all resilience is created equal. Before you can design your AI architecture, you need to understand which type of resilience your business needs most.

1. Demand Resilience: When Customer Behavior Breaks the Models

Your historical data becomes worthless overnight. Customer patterns shift dramatically. New channels emerge while old ones disappear.

Signs you need demand resilience:

Forecast accuracy plummeted during recent disruptions

Customer behavior varies significantly by micro-segment

New products fail or succeed unpredictably

Promotional lift models no longer work

AI Architecture Implications:

Real-time demand sensing capabilities

Ability to incorporate external signals

Rapid model retraining processes

Scenario planning tools

2. Supply Resilience: When Your Vendors Become Variables

Multi-tier visibility becomes critical. Alternative sourcing options need rapid evaluation. Quality and compliance can't slip despite the chaos.

Signs you need supply resilience:

Single-source dependencies keeping you up at night

Supplier disruptions cascading through your network

Inability to see beyond tier-one suppliers

Manual processes for supplier switching

AI Architecture Implications:

Multi-tier visibility platforms

Automated supplier risk scoring

Alternative source identification

Quality prediction models

3. Operational Resilience: When Execution Becomes Everything

Your plans are solid, but execution breaks down. Warehouse labor shortages. Transportation capacity crunches. Last-mile delivery nightmares.

Signs you need operational resilience:

Consistent gaps between planned and actual performance

Heavy dependence on tribal knowledge

Manual workarounds multiplying

Inability to scale operations smoothly

AI Architecture Implications:

Intelligent automation capabilities

Dynamic resource optimization

Predictive maintenance systems

Adaptive routing engines

4. Regulatory Resilience: When Rules Change Faster Than Systems

Compliance requirements shift constantly. Cross-border complexity multiplies. Sustainability reporting becomes mandatory.

Signs you need regulatory resilience:

Compliance fire drills disrupting operations

Manual tracking can’t keep up with regulatory changes

Inconsistent compliance across regions

Growing sustainability reporting burden

AI Architecture Implications:

Automated compliance monitoring

Regulatory change prediction

Audit trail automation

Sustainability tracking systems

Most companies need to adress all these four faces of resilience. But starting with your primary vulnerability focuses your efforts and budget where they matter most.

The Resilience Audit Framework

Hopefully it’s becoming clear that before diving into technology decisions, you need a clear picture of your current resilience gaps. Here's a practical framework for mid-market companies:

Step 1: Map Your Vulnerability Surface

Create a simple heat map:

Probability: How likely is this disruption? (High/Medium/Low)

Impact: How badly would it hurt? (High/Medium/Low)

Recovery Time: How long to bounce back? (Days/Weeks/Months)

Focus on the high-probability, high-impact ones first - if there are ties, prioritize the vulnerability with the longest recovery time.

Step 2: Assess Current Capabilities

For each vulnerability, honestly evaluate:

Detection Speed: When do you know there's a problem?

Response Options: What can you actually do about it?

Recovery Mechanisms: How do you return to normal?

Rate each on a 1-5 scale. Anything below a 3 is a critical gap.

Step 3: Identify Competitive Differentiators

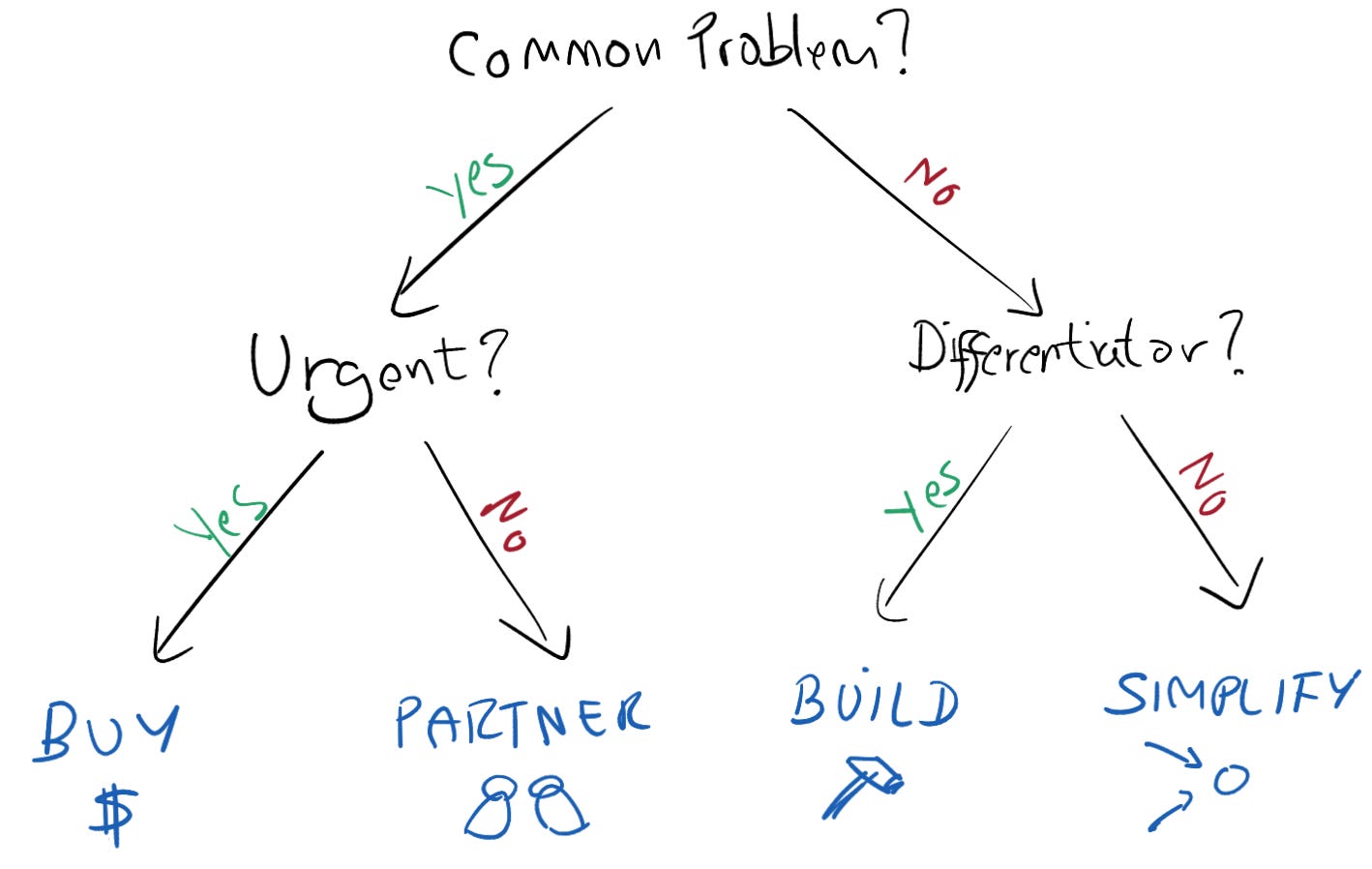

This is crucial for build/buy/partner decisions later:

What do you do that competitors can't easily copy?

Where does your deep market knowledge create advantage?

Which processes are truly unique to your business?

These are candidates for building, not buying.

Step 4: Calculate the Cost of Non-Resilience

CFOs need numbers. For each vulnerability:

Revenue at risk during disruption

Cost of emergency responses

Customer lifetime value impact

Market share erosion potential

The average cost of a supply chain disruption is $1.5 million per day.

In comparison with such nightmares, a $1M one-off resilience investment looks cheap.

Step 5: Define Success Metrics

Hope is not a strategy. As you develop solutions, track these key resilience indicators to ensure you're building real capability, not just technology:

Response Time: How quickly can you detect and adapt to disruptions?

Recovery Speed: How fast can you return to normal operations?

Adaptation Capability: Can you implement alternative plans smoothly?

Competitive Position: Are you more agile than competitors?

Use these metrics throughout your POCs and pilots. If a solution doesn't improve at least one metric significantly, reconsider your approach. The goal is measurable resilience improvement, not just new systems.

Now for the key strategic insight I want you to take away:

Different vulnerabilities require different architectural approaches.

When the Problem is not Unique

If your challenges mirror what hundreds of other companies face - standard demand forecasting, basic inventory optimization, typical transportation management - your architecture should prioritize:

Proven solutions that have solved this problem before

Industry best practices already built in

Rapid deployment of mature capabilities

Focus your resources on execution, not reinvention

This points toward a buy-heavy approach because:

Why reinvent the wheel for commodity problems?

Vendors have refined these solutions across many implementations

You benefit from their accumulated learning

Your differentiation comes from how you operate, not your tools

When Unique Insights Drive Advantage

If your competitive edge comes from understanding your specific market better than anyone:

Proprietary algorithms become strategic assets

Data moats need building

Custom models capture unique patterns

Standard solutions dilute your advantage

This suggests selective building in core areas while buying commodity capabilities.

When Ecosystem Collaboration is Critical

If your resilience depends on tight coordination with partners:

Industry-standard platforms enable data sharing

Common protocols reduce integration friction

Joint visibility prevents surprise disruptions

Shared tools enable coordinated responses

Then go build those partnerships.

The key insight: your vulnerability profile should drive your architecture, not the other way around.

Case Study: Two Roads to Resilience

Let's see how this plays out with two illustrative examples that demonstrate different paths to resilience:

Example A: Regional Food Distributor

Note: These are composite examples based on common patterns in the industry

Revenue: $275M

Primary Vulnerability: Demand volatility from restaurant closures

Secondary Challenge: Shifting to direct-to-consumer channels

Their Approach:

Built: Proprietary demand sensing using local social media, weather, and event data

Bought: Standard WMS and TMS systems

Partnered: With local universities for predictive models

Result: 40% better demand accuracy than competitors using standard solutions. Gained market share during disruptions by anticipating local patterns others missed.

Example B: Industrial Parts Distributor

Note: This illustrative example represents a typical mid-market approach

Revenue: $320M

Primary Vulnerability: Supply disruptions from overseas manufacturers

Secondary Challenge: Customer expectations for real-time visibility

Their Approach:

Built: Custom integration layer connecting all systems

Bought: Best-in-class supply chain visibility platform

Partnered: With logistics providers for real-time tracking

Result: 60% faster response to supply disruptions. Customers stayed loyal because they had visibility even during chaos.

Both succeeded because they matched their architecture to their specific resilience needs, not because they followed a predetermined playbook.

Your Next Steps

The build-vs-buy debate is a distraction. The real question is: What does resilience mean for your specific business?

Start here:

Run the Resilience Audit (2-3 days with your leadership team)

Identify Your Primary Vulnerabilities (Focus on the top 3)

Map Current Capabilities (Be brutally honest)

Define Success Metrics (What does winning look like?)

Only then are you ready to make informed decisions about building, buying, or partnering.

Remember: The goal isn't to have the most advanced AI or the most integrated systems. The goal is to build resilience that protects your business and creates competitive advantage during disruption.

Next week, we'll dive deeper into when building your own AI capabilities makes strategic sense versus when it's an expensive distraction. I'll share frameworks for making this critical decision and reveal what successful companies learned when they built their own "secret sauce."

Note: deeper consideration of system interdependencies, financial constraints, and organizational capabilities are recommended before finalizing a resilience roadmap.

Let's Continue the Conversation

Building resilient supply chain AI architectures is complex, but you don't have to figure it out alone.

If you're ready to move from strategy to action, I offer fractional strategic AI services tailored for companies that need AI leadership without the full-time executive cost. I work with a limited number of clients to ensure deep, focused, 100% personal engagement.

Interested in exploring if this could work for your organization? Let's start with a conversation.